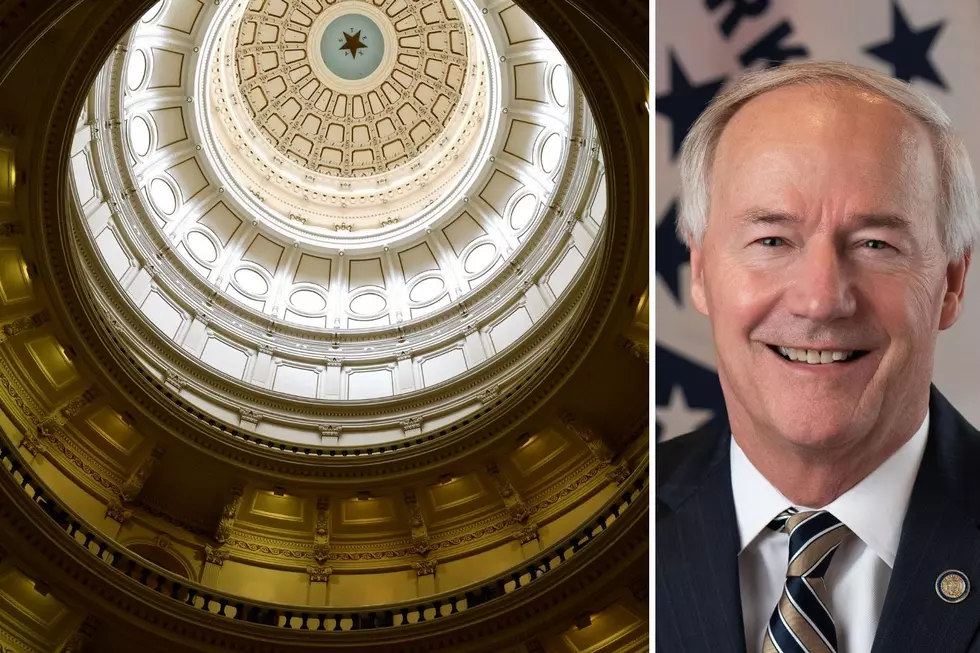

Tax Relief and School Safety Tops in Arkansas’ Special Session

Governor Asa Hutchinson has issued a Call for the Third Extraordinary Session of the 93rd General Assembly. The main purpose of this Session is to provide immediate tax relief for Arkansans, and also, to set aside $50 million for a school safety grant program.

"As inflation rises and the cost of living increases, Arkansans need more money in their pockets," Governor Hutchinson said. "With a record surplus in the last year fiscal year, we have the ability to provide financial relief and ensure our children can be protected in their schools."

This legislative session will consist of the following items:

- Lower the top individual tax rate to 4.9%, retroactive to January 1, 2022, saving taxpayers $295 million in 2022.

- Lower the corporate income tax rate to 5.3%, beginning January 1, 2023

- Create a $150 nonrefundable low- and middle-income tax credit, saving taxpayers $156.3 million in 2022

- Align Arkansas law with the federal depreciation schedule

- Transfer $50 million from the state surplus for the purpose of a school safety grant program, consistent with the recommendations of the Arkansas School Safety Commission.

The tax provisions listed above will provide financial relief for Arkansans of all income levels. Additionally, aligning Arkansas' law with the current IRS depreciation schedule will help business owners accelerate the depreciation of their assets, which makes it easier for the calculation of their tax bill.

The $50 million to be set aside for the school safety grant, is in response to the Arkansas School Safety Commission interim report to Governor Hutchinson on August 2nd. The program will provide funding for school districts to increase security measures on their campuses. To view the Governor's Call click HERE.

Take A Peek Inside This 10 Million Dollar Barndominium In Arkansas

Cosmic Caverns - Berryville, Arkansas

Ghost Town of Rush Arkansas

More From Eagle 106.3